Increasing _ Will Improve Your Net Worth: Key Strategies for Financial Growth

Increasing your income is a critical component of enhancing your net worth, yet many overlook the nuanced strategies that can catalyze this growth. By diversifying revenue streams and actively seeking side opportunities, individuals can not only mitigate financial risk but also position themselves for significant wealth accumulation. However, the path to financial growth encompasses more than just income; it requires a comprehensive approach to budgeting, investment, and personal development. Understanding these interconnected strategies can unlock new avenues for economic stability and independence, prompting a closer examination of the steps you can take today.

Understanding Net Worth

Understanding net worth is crucial for individuals seeking to assess their financial health and make informed decisions regarding wealth accumulation and management.

The net worth definition hinges on the net worth calculation, which balances financial asset types against liabilities impact.

Employing wealth measurement methods, net worth tracking reveals financial health indicators, while effective asset diversification strategies enhance one’s financial standing, fostering true economic freedom.

See also: Ilana Muhlstein Net Worth: How Much Is the Nutrition Expert Worth?

Increasing Your Income

Enhancing your income is a vital step in improving your overall net worth, as it allows for greater investment opportunities and increased capacity to manage liabilities.

Embracing side hustles benefits not only provides additional revenue streams but also fosters income diversification, mitigating risks associated with reliance on a single source.

This strategic approach empowers you to achieve financial freedom and build lasting wealth.

Building a Strong Budget

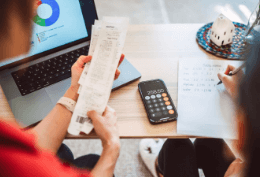

Establishing a strong budget is fundamental to achieving financial stability and growth.

By meticulously tracking your expenses, you gain a clearer understanding of your spending habits, enabling you to identify areas for improvement.

Additionally, setting specific financial goals provides direction and motivation, ensuring that your budgeting efforts align with your long-term aspirations.

Track Your Expenses

Effectively tracking your expenses is a fundamental step in building a robust budget that empowers you to achieve financial stability and growth.

Expense tracking enhances financial awareness, allowing you to identify spending patterns and areas for improvement.

Set Financial Goals

Setting clear financial goals is essential for creating a strong budget that not only guides your spending but also propels you toward long-term financial success and stability. By defining short-term goals alongside a long-term vision, you can effectively allocate resources and track progress.

| Timeframe | Goal Type |

|---|---|

| Short Term | Emergency Fund |

| Mid Term | Debt Reduction |

| Long Term | Retirement Savings |

Developing Smart Investment Strategies

In an increasingly complex financial landscape, crafting intelligent investment strategies is essential for maximizing returns while minimizing risk.

By diversifying portfolios across various asset classes, investors can mitigate potential losses and enhance stability.

Effective risk management techniques, such as setting stop-loss orders and regularly reviewing investments, empower individuals to navigate market fluctuations, thereby fostering greater financial independence and ultimately improving net worth.

Enhancing Your Savings Rate

To achieve long-term financial stability, enhancing your savings rate is a critical strategy that empowers individuals to build wealth and prepare for unforeseen expenses.

Establishing strong savings habits not only contributes to a robust emergency fund but also fosters financial independence.

Reducing Debt Effectively

Building a solid savings foundation naturally leads to a heightened awareness of outstanding debts, making effective debt reduction a vital component of a comprehensive financial growth strategy.

Implementing debt consolidation can simplify repayment efforts, while robust credit management practices help minimize interest rates and penalties.

Together, these strategies empower individuals, facilitating financial freedom and ultimately enhancing one’s net worth through reduced liabilities.

Leveraging Passive Income Streams

Leveraging passive income streams can significantly enhance financial stability and growth, allowing individuals to generate revenue with minimal ongoing effort.

Strategies such as investing in real estate for rental income, purchasing dividend stocks, establishing online businesses, or engaging in affiliate marketing provide diverse avenues for wealth accumulation.

Additionally, royalty earnings, peer-to-peer lending, and automated investing create sustainable cash flow, fostering long-term financial freedom.

Investing in Personal Development

Investing in personal development is a critical strategy for financial growth, as it enhances skill acquisition, which can lead to increased earning potential.

Furthermore, personal development fosters networking opportunities that can open doors to new career prospects and collaborations.

Emphasizing lifelong learning not only keeps individuals relevant in a rapidly changing job market but also positions them for sustained success.

Skill Acquisition Benefits

Acquiring new skills is a fundamental component of personal development that not only enhances individual capabilities but also significantly contributes to long-term financial growth and career advancement. Skill diversification through continuous education fosters adaptability training, enhances marketability, and strengthens personal branding, ultimately leading to expertise development. Engaging in professional networking further amplifies these benefits, promoting sustained financial success.

| Benefits | Impact on Career Advancement | Role in Financial Growth |

|---|---|---|

| Skill Diversification | Broadens job opportunities | Increases income potential |

| Adaptability Training | Prepares for market changes | Ensures job security |

| Expertise Development | Builds trust and reputation | Enhances investment value |

Networking Opportunities Expansion

Expanding networking opportunities is crucial for personal development, as it fosters valuable connections that can lead to collaborative ventures and career advancements.

Engaging in networking events allows individuals to cultivate professional relationships that enhance their visibility and credibility.

Lifelong Learning Importance

Continuous personal development through lifelong learning significantly enhances an individual’s ability to adapt to changing market demands and seize new opportunities for financial growth.

Engaging in continuous education fosters knowledge enhancement, empowering individuals to innovate and thrive.

This investment in personal development not only elevates skills but also expands potential income streams, ultimately leading to greater financial independence and net worth.

Setting Financial Goals

Establishing clear and measurable financial goals is essential for individuals and organizations alike, as it provides a structured roadmap for achieving long-term financial stability and growth.

Utilizing goal visualization techniques enhances motivation, while the benefits of having an accountability partner can significantly increase your commitment to these goals.

Together, these strategies empower you to take control of your financial future and drive meaningful progress.

See also: Hustle Cartel Gaming Net Worth: A Look at the Influencer’s Wealth

Conclusion

In the pursuit of financial growth, increasing income serves as a sturdy foundation upon which a prosperous future can be built.

Like a tree that flourishes with diverse roots, a multifaceted approach encompassing budgeting, investment, and debt reduction allows for robust net worth expansion.

Each strategic step taken acts as a branch reaching toward the sky, symbolizing the potential for greater financial independence.

Ultimately, a commitment to these principles cultivates a flourishing financial landscape, ripe for long-term success.